salt tax repeal march 2021

Over 50 percent of this reduction would accrue to taxpayers in just four. But the Tax Cuts and Jobs Act limited that deduction to 10000.

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

54 rows January 25 2021.

. In the most recent push to repeal the cap SALT caucus co-Chair Rep. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. Last year Democrats proposed lifting the cap on the SALT deduction for 2020 and 2021 as part of a COVID-19 relief package arguing that it would provide relief to people hit hardest by the CCP virus.

According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years. 31 2020 and the first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital advertising tax revenues is due to the states Comptroller by April 15 2021. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

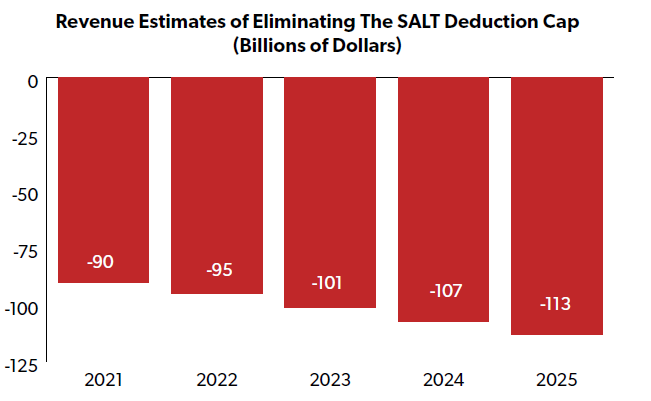

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen.

Today Congressman Tom Suozzi D-Long Island Queens issued the following statement. The prudent course does appear to be to properly elect if applicable and pay by Dec. Paying a state income tax of 10 percent or more.

No SALT no deal. Josh Gottheimer D-NJ said in a statement. As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap.

Accordingly Grant Thornton has formulated 10 predictions covering the SALT issues that we believe will be of major focus in 2021. The new tax is applicable to all taxable years beginning after Dec. Americans who rely on the state and local tax SALT deduction at.

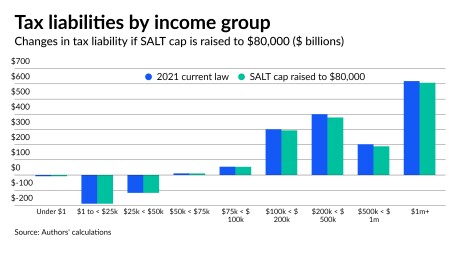

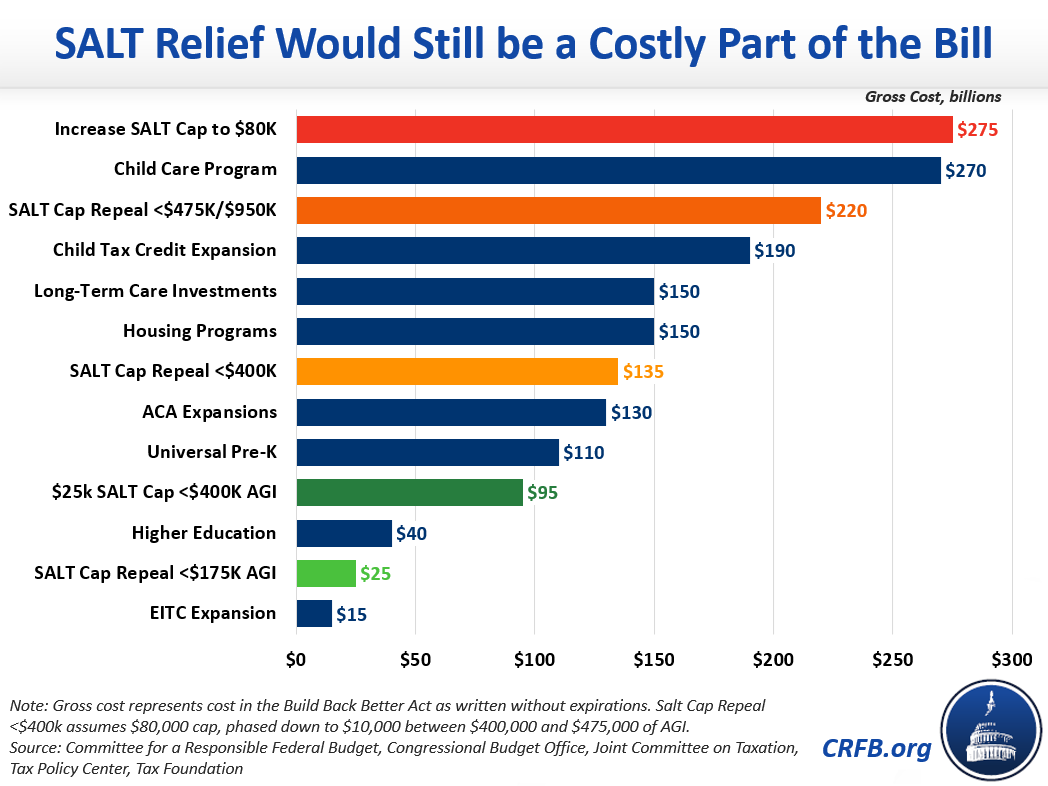

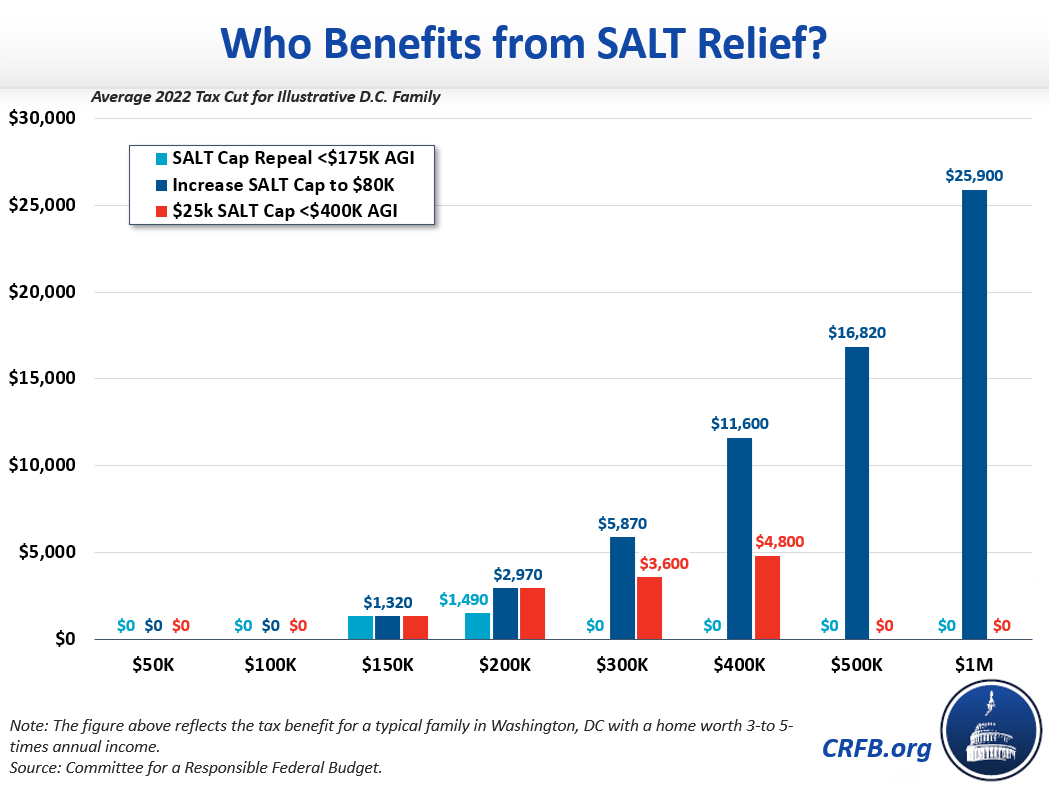

That was bad news for top earners in blue states such as California and New York. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. Congress seems to be considering two ways to address the Tax Cut and Job Acts 10000 cap on the state and local tax SALT deduction.

Various Democrats and some Republicans in. Most people do not qualify to itemize after the 2017 tax reform. SALT Cap Repeal Below 500k Still Costly and Regressive.

The change may be significant for filers who itemize deductions in high-tax states and. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. 31 2021 depending on the state PTE regime in order to benefit from the SALT cap deduction in 2021 Many firms are advising clients to pay the tax by year end to be on the safe side and comply with the four corners of the notice Scott said.

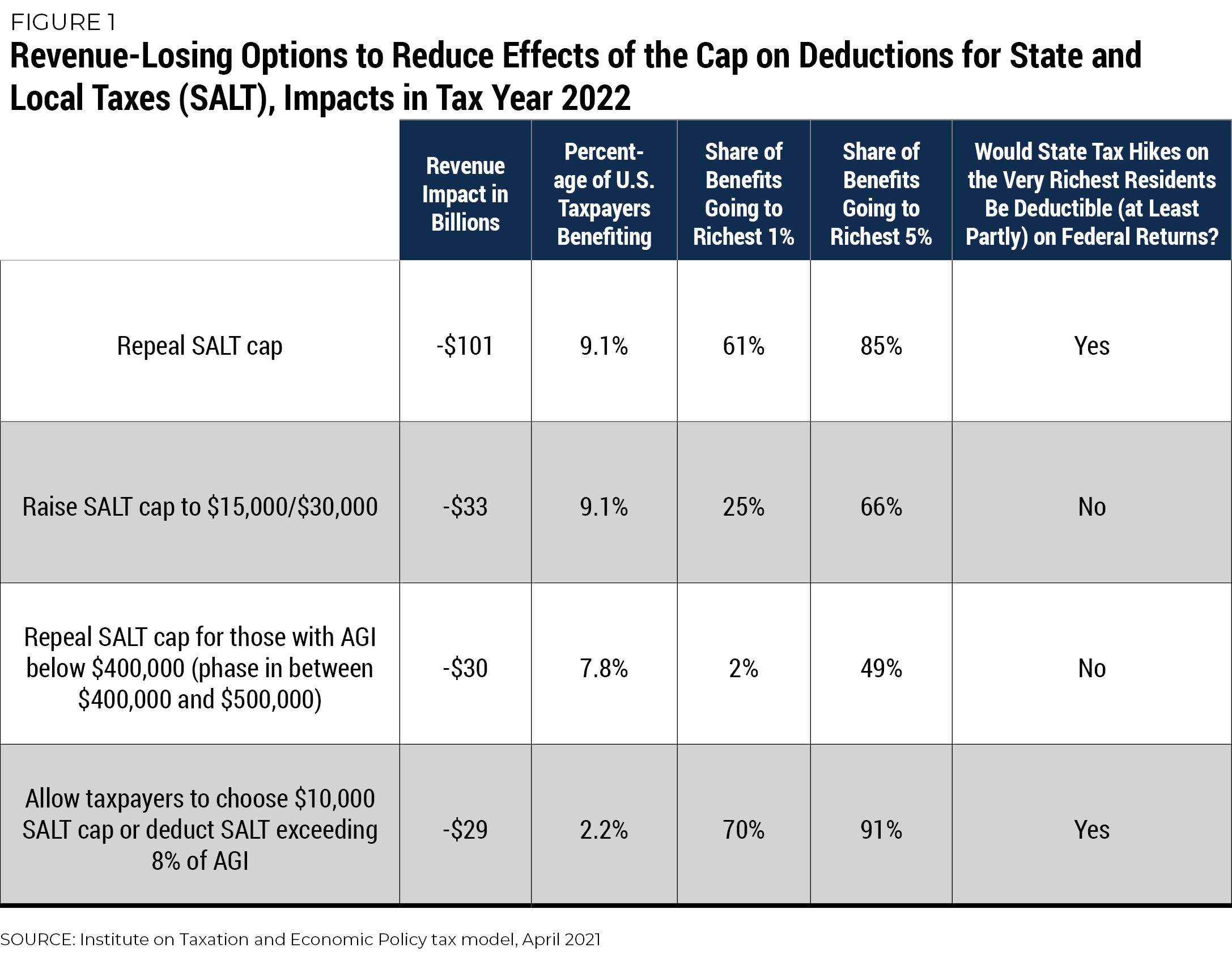

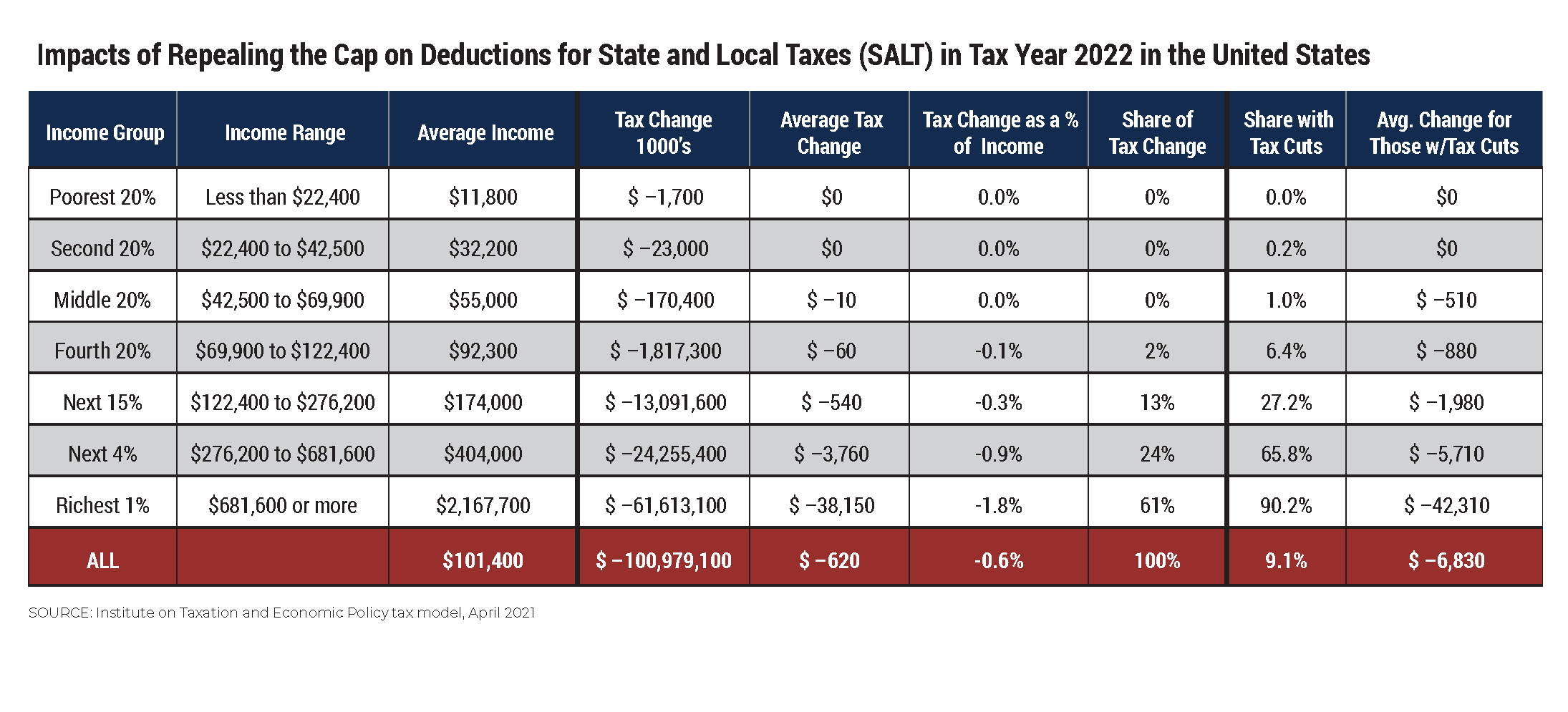

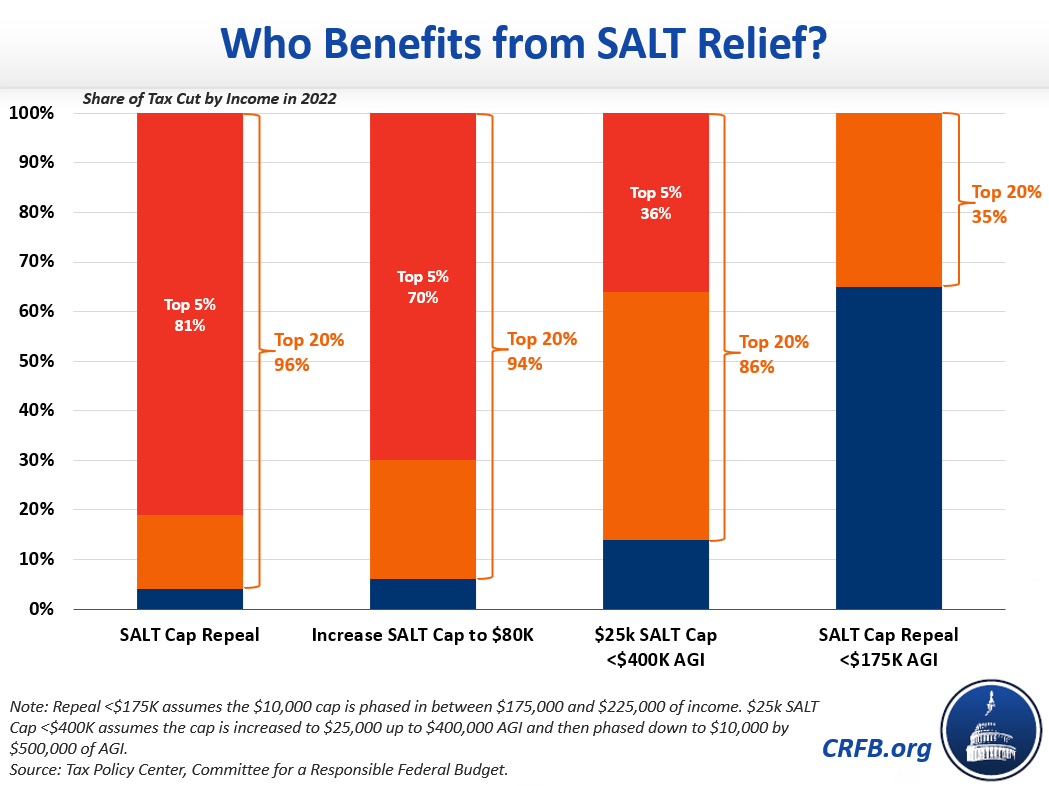

April 19 2021 629pm. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. Such a plan would be still be very costly and regressive delivering the largest tax cut to very high-income households.

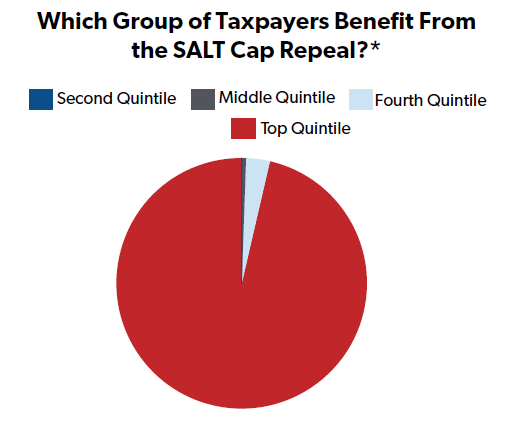

Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction according to new. Three House Democrats say they wont support any of President Joe Bidens tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the 10000 cap on state and local. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package.

Alabama Enacts Significant Corporate Tax and COVID-19 Relief. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue. Andrew Cuomo says President Bidens infrastructure package should include repeal of the SALT cap.

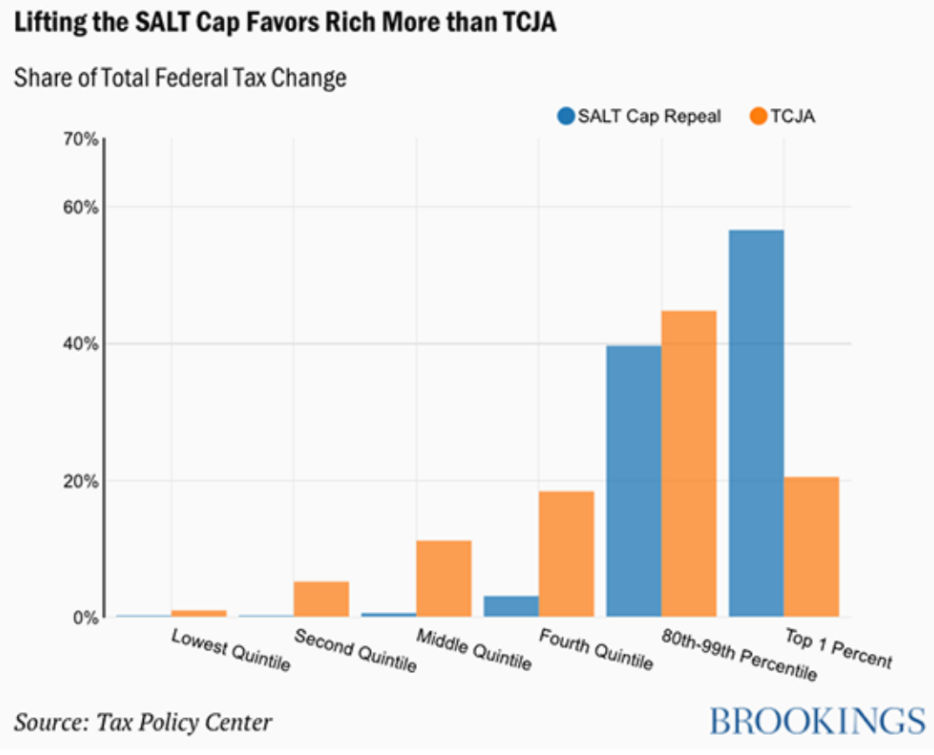

However the bill stalled in December. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. The liberal-leaning Brookings Institution estimates that eliminating the SALT cap would give members of the top.

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at. Continued CARES Act responses As discussed above the federal government enacted the CARES Act on March 27 2020 to provide substantial economic relief to both businesses and individuals in. The bill devotes nearly 300 billion to increasing the cap on the state and local tax deduction known as the SALT deduction from 10000 to 80000 through the end of 2025.

Dec 11 2021. With only a 3 vote Democratic Majority in the House Suozzi will work to have other Members join his pledge. AFP via Getty Images.

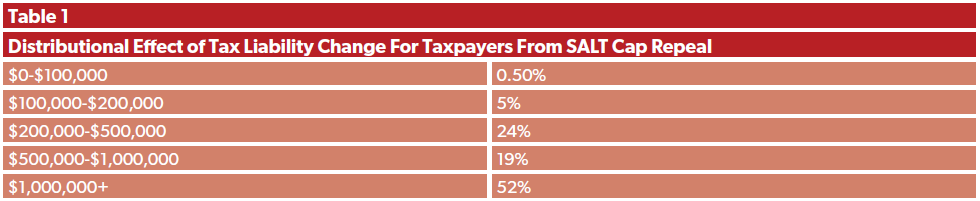

52 rows For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Just 05 percent of the tax relief would go to households making less than 100000.

Middle-income households would get an average 2021 tax. Our 2021 predictions 1. March 30 2021.

March 1 2022 600 AM 5 min read.

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

State And Local Tax Salt Deduction Salt Deduction Taxedu

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

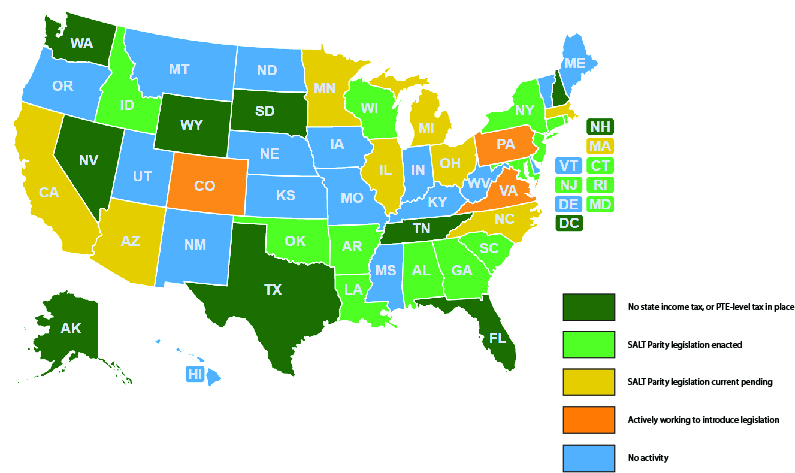

Salt Parity Continues To Roll The S Corporation Association

Salt Cap Repeal Disproportionately Favors Wealthy People R Neoliberal

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Chuck Schumer Salt Deduction Cap Repeal Tax Bailout For Rich Liberals National Review

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Salt Satyagraha Movement Or Dandi March Scorebetter

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget