aurora sales tax calculator

The average cumulative sales tax rate in Aurora Minnesota is 738. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

The December 2020 total local sales tax rate was 8350.

. The Sales tax rates may differ depending on the type of purchase. US Sales Tax Rates OH Rates Sales Tax Calculator Sales Tax Table. The current total local sales tax rate in Aurora SD is 5500.

The Sales tax rates may differ depending on the type of purchase. Method to calculate Aurora sales tax in 2021. Aurora is in the following zip codes.

The current total local sales tax rate in Aurora OR is 0000. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. This includes the rates on the state county city and special levels.

One of a suite of free online calculators provided by the team at iCalculator. You can find more tax rates and allowances for Aurora and Colorado in the 2022 Colorado Tax Tables. The County sales tax rate is.

Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. 2020 rates included for use while preparing your income tax deduction. If this rate has been updated locally please contact us and we.

Aurora is in the following zip codes. The average cumulative sales tax rate in Aurora Ohio is 7. The average cumulative sales tax rate in Aurora Illinois is 825.

The Aurora Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Aurora Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Aurora Colorado. Fast Easy Tax Solutions. This includes the rates on the state county city and special levels.

The minimum combined 2022 sales tax rate for Aurora Illinois is. The Aurora Illinois sales tax is 825 consisting of 625 Illinois state sales tax and 200 Aurora local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Aurora is in the following zip codes.

The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax. The Illinois sales tax rate is currently. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

US Sales Tax Rates OR Rates Sales Tax Calculator Sales Tax Table. US Sales Tax Rates MO Rates Sales Tax Calculator Sales Tax Table. This includes the rates on the state county city and special levels.

US Sales Tax Rates SD Rates Sales Tax Calculator Sales Tax Table. Aurora Sales Tax Rates for 2022. ICalculator US Excellent Free Online Calculators for Personal and Business use.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. North Aurora is located within Kane County Illinois. The sales tax rate does not vary based on zip code.

The December 2020 total local sales tax rate was also 0000. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Within Aurora there is 1 zip code with the most populous zip code being 55705.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Within North Aurora there is 1 zip code with the most populous zip code being 60542. The Aurora Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Aurora Nebraska in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Aurora Nebraska.

The December 2020 total local sales tax rate was 7250. The current total local sales tax rate in Aurora MO is 8850. Did South Dakota v.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. This rate includes any state county city and local sales taxes. Aurora collects a 16 local sales tax the maximum local sales tax allowed under Utah.

The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city sales tax. Aurora is located within St. The Aurora sales tax rate is.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. Aurora collects a 4125 local sales tax the maximum local sales tax allowed under. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables.

Method to calculate Aurora sales tax in 2021. This includes the rates on the state county city and special levels. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7.

Aurora Sales Tax Rates for 2022. The Aurora Sales Tax is collected by the merchant on all qualifying sales. See how we can help improve your knowledge of Math.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Wayfair Inc affect Illinois.

The average cumulative sales tax rate in North Aurora Illinois is 75. The sales tax rate does not vary based on zip code. This is the total of state county and city sales tax rates.

The latest sales tax rate for Aurora NE. Aurora is in the following zip codes. The current total local sales tax rate in Aurora OH is 7000.

The December 2020 total local sales tax rate was also 5500. Aurora has parts of it located within DuPage County Kane County and Will County. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

The Aurora Missouri sales tax is 835 consisting of 423 Missouri state sales tax and 413 Aurora local sales taxesThe local sales tax consists of a 163 county sales tax and a 250 city sales tax. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Within Aurora there are around 8 zip codes with the most populous zip code being 60505. Ad Find Out Sales Tax Rates For Free. Aurora is located within Portage County OhioWithin Aurora there is 1 zip code with the most populous zip code being 44202The sales tax.

The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora South Dakota Sales Tax Comparison Calculator for 202223. NE Rates Sales Tax Calculator Sales Tax Table.

New York Sales Tax Rates By City County 2022

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

What Is The Sales Tax On A Car In Illinois Naperville

Whitchurch Stouffville Property Tax 2021 Calculator Rates Wowa Ca

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

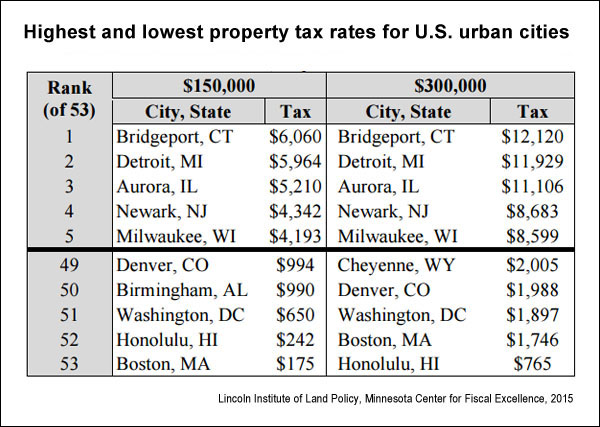

U S Property Taxes Comparing Residential And Commercial Rates Across States

Calculators Officestationery Co Uk

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Aurora Colorado Sales Tax Rate Sales Taxes By City

How To Calculate Cannabis Taxes At Your Dispensary

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Kansas Sales Tax Rates By City County 2022

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Illinois Car Sales Tax Countryside Autobarn Volkswagen